The looting of the Covid relief program known as PPP

11 min readThey bought Lamborghinis, Ferraris and Bentleys.

And Teslas, of course. Lots of Teslas.

Many who participated in what prosecutors are calling the largest fraud in U.S. history — the theft of hundreds of billions of dollars in taxpayer money intended to help those harmed by the coronavirus pandemic — couldn’t resist purchasing luxury automobiles. Also mansions, private jet flights and swanky vacations.

They came into their riches by participating in what experts say is the theft of as much as $80 billion — or about 10 percent — of the $800 billion handed out in a Covid relief plan known as the Paycheck Protection Program, or PPP. That’s on top of the $90 billion to $400 billion believed to have been stolen from the $900 billion Covid unemployment relief program — at least half taken by international fraudsters — as NBC News reported last year. And another $80 billion potentially pilfered from a separate Covid disaster relief program.

The prevalence of Covid relief fraud has been known for some time, but the enormous scope and its disturbing implications are only now becoming clear.

Even if the highest estimates are inflated, the total fraud in all Covid relief funds amounts to a mind-boggling sum of taxpayer money that could rival the $579 billion in federal funds included in President Joe Biden’s massive 10-year infrastructure spending plan, according to prosecutors, government watchdogs and private experts who are trying to plug the leaks.

“Nothing like this has ever happened before,” said Matthew Schneider, a former U.S. attorney from Michigan who is now with Honigman LLP. “It is the biggest fraud in a generation.”

Most of the losses are considered unrecoverable, but there is still a chance to stanch the bleeding, because federal officials say $600 billion is still waiting to go out the door. The Biden administration imposed new verification rules last year that administration officials say appear to have made a difference in curbing fraud. But they acknowledge that programs in 2020 sacrificed security for speed, needlessly.

Justice Department Inspector General Michael Horowitz, who oversees Covid relief spending, told “NBC Nightly News” anchor Lester Holt in an exclusive interview that Covid relief programs were structured in ways that made them ripe for plunder.

“The Small Business Administration, in sending that money out, basically said to people, ‘Apply and sign and tell us that you’re really entitled to the money,’” said Horowitz, the chair of the Pandemic Response Accountability Committee. “And, of course, for fraudsters, that’s an invitation. … What didn’t happen was even minimal checks to make sure that the money was getting to the right people at the right time.”

The criminal methodology varied depending on the program. The epic swindle of Covid unemployment relief has been carried out by individual criminals or organized crime groups using stolen identities to claim jobless benefits from state workforce agencies disbursing federal funds. Each identity could be worth up to $30,000 in benefits, Horowitz said.

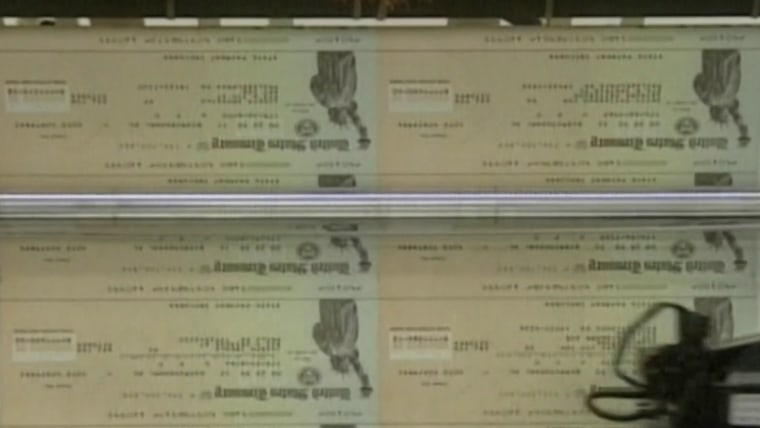

The looting of the Paycheck Protection Program worked differently — and it could be far more lucrative. The program authorized banks and other financial institutions to make government-backed loans to businesses, loans that were to be forgiven if the companies spent the money on business expenses. Nearly 10 million such loans have already been forgiven. Many of the loans-turned-grants were for millions of dollars, public records show.

Experts say millions of borrowers inflated their numbers of employees or created companies out of whole cloth. For much of 2020, lenders did little to verify the applications, prosecutors and experts say, in part because Congress required the Small Business Administration, or SBA, which ran the program, to issue explicit guidance that in the interest of getting the money out fast, lenders “will be held harmless for borrowers’ failure to comply with program criteria.” The Government Accountability Office warned of fraud risk, but the program continued under that rule.

“The government spent approximately $800 billion and provided 21 million loans to individuals,” said Haywood Talcove, the CEO for government at LexisNexis Risk Solutions, which works with the government to verify identities.

No one is sure exactly how much was stolen. An academic paper released last year estimated at least $76 billion in potential fraud, and the authors said that was conservative.

The SBA’s inspector general has identified $78.1 billion in potentially fraudulent Economic Injury Disaster Loans, another Covid relief program for businesses. The Secret Service has its own estimate: $100 billion.

The basic scheme, Talcove said, was “really simple.” People went on state websites and took the names of existing businesses or registered new, fake ones.

“There’s absolutely no security on there. There’s no validation of any information,” Talcove said. “And voila, you have company ABC with 40 employees and a payroll of $10 million. And you go and apply for a PPP loan. It was a piece of cake.”

To find more cases, the Pandemic Response Accountability Committee is employing data scientists who use artificial intelligence to plow through 150 million records searching for fraud patterns. In one case it found that a phone number for a gas station in Houston was used on 150 loan applications. It sends such leads to federal agents who follow up on foot.

One of the centers of the fraud is Miami, where Juan Gonzalez is the U.S. attorney in the Southern District of Florida.

Gonzalez said that unlike with unemployment relief, which went to every person who qualified, lenders had to stop making PPP loans when the money ran out, even though demand continued. The fraud didn’t harm just the taxpayers — it hurt people who needed the money.

The public, he said, “should be very angry.”

“This is billions of taxpayer dollars that has been stripped from them,” he said. “And more angry should be the people who did lose their jobs, who worked for businesses that couldn’t apply for this money because it was gone. Those are really the ones who should be the angriest of all.”

Gonzalez said he has seen a lot of fraud in Florida, including billions pilfered every year from the federal Medicare program. But never has so much been stolen so quickly, he said.

“I have a hard time imagining when so much money has gone so quickly into the hands of people who don’t deserve it,” he added.

David Hines, 29, of Miami, for example, admitted to a fraud scheme that netted him $3.9 million, according to his guilty plea. Hines, who said in court papers that he struggled with addiction, bought a $318,000 Lamborghini Huracán. He also spent thousands on luxury hotels, jewelry, clothing and dating sites, say prosecutors, who seized the car and recovered much of the money.

Also in Miami, a man and a woman admitted to a complex scheme in which, among other things, they claimed they were operating farms — with many employees — out of small, single-family homes in the middle of the city.

“Once you looked at the paperwork and once you saw what it was, all it took was a drive to the farm to see there was no farm,” Gonzalez said.

In another Florida case, prosecutors have charged a man who they say used proceeds from a $7.2 million emergency loan to buy a 12,579-square-foot mansion, a Lincoln Navigator car, a Maserati and a Mercedes-Benz.

A California couple were convicted in June of stealing $18 million, with which they bought three houses, diamonds, gold coins, luxury watches, expensive furniture and other valuables, prosecutors said. Just as they were to be sentenced, they cut off their ankle bracelets and fled, leaving their children behind, according to the FBI.

They were captured in February in Montenegro. The man was sentenced to 17 years in prison, and his wife got six years.

Their case underscores that most of the defendants have been freed while they have awaited trial and sentencing, even though they have been accused of stealing huge sums.

Washington, D.C., resident Elias Eldabbagh, who appears to have no criminal record, was charged last summer with trying to steal $17 million from PPP and another program. According to his LinkedIn page, he earned a degree in computer engineering from California State University, Sacramento, and has worked in various technology jobs. Among the property prosecutors seized was a Tesla Model 3.

He had been released on his own recognizance as he awaited trial, but he was recently jailed after prosecutors accused him of a new crime — attempting to defraud a bank — while his original case was pending. Court records show he has pleaded not guilty. His lawyer declined to comment.

In the annals of Covid fraud cases, few have matched the brazenness suspected of Danielle Miller, according to federal prosecutors in Boston, where she was charged. The charging documents in her case say she stole identifying information from a Massachusetts state website and used the information to apply for Covid relief loans.

In 40 minutes, she had $100,000 in taxpayer money, court documents say. She soon booked a private jet from Florida to California, where she spent $5,500 at a luxury hotel in West Hollywood, court papers allege.

On her Instagram account, which has 34,000 followers, Miller posted photos from two posh hotel stays paid for with criminal proceeds, prosecutors say. Her bio: “I want that.”

“Miller’s criminal record includes arrests in five different states, many of which were related to larceny and identity-related fraud,” the complaint in the case says.

Miller pleaded not guilty, but court records now say she intends to plead guilty to an unspecified charge.

She participated in a recent profile in New York magazine that portrayed her as a child of wealthy Manhattan parents whose life was derailed by the circulation of a sexually explicit video when she was in the eighth grade.

“Honestly, I more so consider myself a con artist than anything,” the magazine quoted her as saying. “You know how they have that saying that you can sell ice to an Eskimo? If there’s something that I want, I’m getting it.”

Hines got six years in prison, and the fraudulent farmers got 18 and 30 months. But Gonzalez and other government officials acknowledge that for every person caught, many, many more have gotten away with it. And while prosecutors have 10 years to go after the fraud, given the enormous scope of the criminality, the Justice Department simply doesn’t have the resources to go after it all.

“I think there’s going to be a percentage that we probably will never catch,” he said. “But we’re working as hard as we can to catch as many as we can.”

Across the country, only 178 people have been convicted so far in PPP fraud cases, according to the Justice Department. Many more prosecutions are coming, but even if the numbers reach 2,000 — or 20,000 — it will be only a small fraction of the fraud.

So how was this allowed to happen? There are two prevailing theories, one more forgiving of the government than the other.

Many government officials, including Gonzalez, say that because the government was trying to respond quickly during the pandemic, a conscious decision was made to make the application process as smooth as possible, even at the expense of thorough vetting.

“You have government releasing a lot of money as quickly as possible into the hands of people who really need it,” he said. “As usually happens, the faster the money needs to go out, the less likely there are to be the appropriate checks in place to make sure that people who don’t deserve that money don’t get it.”

“What surprised me the most is just how blatant it was,” Gonzalez said. “How individuals would just go ahead and lie on these applications — get the money and then go ahead just openly spend it … thinking that they’re going to do that without anybody checking up on it.”

He added: “Some fraud is inevitable. That’s the price that the government was willing to pay to get the money as quickly as possible into the hands of those that really needed it.”

As for the lenders, he said, “perhaps because it was not their money that was on the line, some of these institutions didn’t do the type of diligence they should’ve done.”

The case of the California couple pursued by the SBA inspector general appears to illustrate that fraudsters were leveraging the apparent incuriosity of those doling out the cash.

The defendants, Richard Ayvazyan and Marietta Terabelian, got millions of dollars by using stolen identifies to get around Ayvazyan’s disqualifying 2011 conviction for bank fraud, court records say. They texted about the cash that was available: “You need to apply. 10k guaranteed…they don’t check for s—…it’s all automated.”

Days later, they were texting that they had gotten the money. “I did 7 [applications] last night and 4 of them got email that it’s funded…I’m telling you to apply [to] Bluevine,” an online lender.

“how much they send u”

“Like over 500 so far.”

Congressional officials say they are investigating a half-dozen lenders and service providers, including Bluevine, which processed loan applications for $4.5 billion and touted that a business could get loan approval in five minutes.

Bluevine said in a statement that it used “robust compliance” to reduce fraud in accordance with government guidelines and that it was “regrettable” that the government’s loan programs were “abused by bad actors … despite our best efforts.”

Talcove, whose company maintains huge databases of public records and sells verification services to governments, says the government and the lenders and banks could and should have prevented such widespread fraud.

When Covid relief was proposed, he said, he spoke to Larry Kudlow, then a top economic adviser to President Donald Trump.

“And I explained to him that this was going to be the biggest fraud in the history of our country. And then I was told that you can have speed or you can have security. And that they’d rather just get the money out.”

Talcove said he told Kudlow that banks have the ability to rapidly identify their customers.

Kudlow didn’t respond to requests for comment.

The idea that there is a tradeoff between speed and security “is a false premise,” Talcove said. “It’s not true. If you believed that, then some of our biggest companies in this country that face consumers would be bankrupt, right? It is very easy to stop the type of fraud that we’re looking at. In fact, the private sector stopped this a decade ago.

“The problem that happened is the states panicked, as well as the Small Business Administration.”

In a statement, the SBA said it “takes fraud seriously, and, as such, all applicants are required to provide certification of their eligibility upon application.”

“Misrepresentation of eligibility is unlawful, and, when appropriate, these cases are referred to the Office of the Inspector General,” it said.

But an official who works on Covid relief and wasn’t authorized to speak publicly acknowledged that Talcove is correct. In the early stages of the loan program, he said, there were few controls. And it didn’t have to be that way.

“I agree,” he said, “that the notion that you had to sacrifice certainty for speed is categorically false.”